A Changing World: China, end of the momentum at the largest fashion market

The trade war and the downturn threaten the second world power, which sees its goal to surpass the United States as the first global power delayed.

Fashion business’ game board has turned around. The legacy of the crisis, instability, the peak of populist movements, the attempts to move backwards in globalization and the threat of the global economic downturn has made almost all the predictions fail one by one. The world undergoes a transformation, and fashion, as a global player, must adapt and transform with it. Modaes.es will go through the keys for the new order in the most important markets in the sector and how this can affect one of the most globalized business in the world.

Agricultural giant impoverished first, the great factory of the world after and, now, a huge and super technological consumer market. What took several centuries for Europe to achieve, China managed to achieve it in just a few decades, in one of the fastest transformations in history. In 2019, the Asian giant faces a new threat of slowdown and negotiations with the United States, in which it has more to lose than to win.

After years of intense investment to work the economic miracle, the overheated Chinese economy begins to show cooling down symptoms. The Shanghai Stock Exchange Composite Index recorded the biggest fall of the globe in 2018, with a decrease of 24.6%.

Although the Chinese stock market is not the best indicator to measure the evolution of the country, with a highly interventionist state, the rest of the macroeconomic data point in the same direction.

The country closed 2018 with a growth of only 6.6%, its lowest rise since 1990, although above the Government's expectations, which stood at 6.5%. Since 2008, China has only accelerated two years: in 2010 and in 2017.

Industrial production is also slowing down, car sales fell in 2018 for the first time in almost three decades and retail as a whole has left behind double-digit growth, with increases of 8.6% in October and 8.1 % in November, well below the average of 13.93% registered between 1993 and 2018.

This downturn is already having an impact on companies: at the beginning of January, Apple attributed the fall in sales to the slowdown of the Asian giant, where it generates 20% of its revenue. "We did not know how to predict the magnitude of the economic downturn, especially in China," said Tim Cook, chief executive of the technology giant, in a letter sent to shareholders.

Forecasts suggest that this scenario will maintain, if not worsen, during the next months. “China needs to take more aggressive measures to stabilize growth,” said last week the financial group Nomura, which also anticipates a growing slowdown for the upcoming months.

Most analysts agree that Beijing will reduce its growth forecast to 6%, compared to the current 6.5%, due to the impact of the trade war, the stagnation of consumption and the increase in regulations, partly due to the requirements that are imposed to be considered as market economy, one of Beijing’s great obsessions.

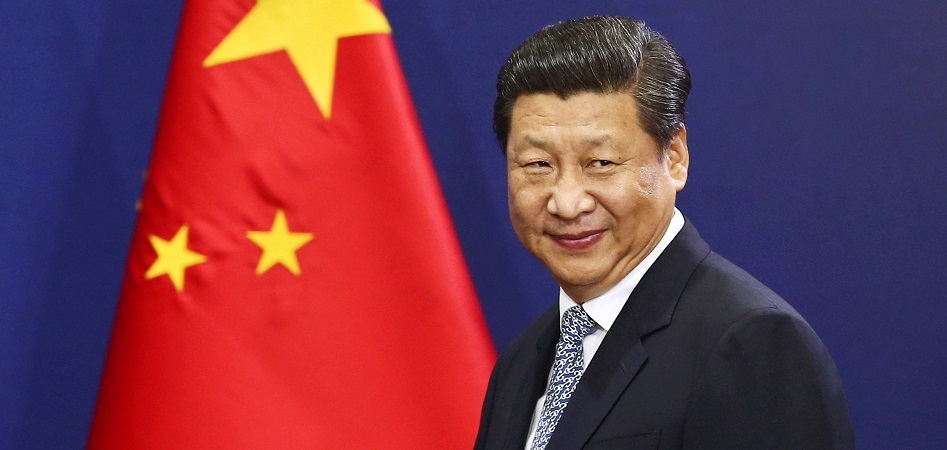

In this scenario, the Government of Xi Jinping, which had tried to deleverage in the last year, has once again decided on expansionary measures despite its mounting debt, which already reaches 253% of the GDP.

The Xi administration has started the year with a set of measures that include lowering taxes, reducing administrative fees, granting aid to companies and relaxing monetary policy, but some analysts suggest that may not be enough in an already overinvested market, with abandoned factories and empty houses throughout its extensive territory.

“China can ask banks to lend more money, but it is hard to convince companies to ask for it if they do not need it,” explained Forbes in an article last week. The same applies to infrastructure: major projects have already been completed, including the airport macro-terminal (the largest in the world) that will open in the district of Daxing (south of Beijing) this year.

Negotiation with US: the great battle of 2019

But the great battle for this year will be the negotiation with the United States to stop the trade war. This month the two powers began talks, in which China has more to lose than its rival.

The latest foreign trade data are not positive: Chinese imports fell by 7.6% in December, compared to the forecasted rise of 5%, while exports fell by 4.4%, its largest descent in two years. On the other hand, sales to the United States fell by 3.7%.

This situation adds even more pressure to a country immersed in an ambitious reconversion plan, which involves reducing its dependence on exports and foreign investment and boosting internal consumption instead. For that purpose, it must face major challenges, such as the high cost of services like education and the wages that are still low, especially outside big cities.

The fastest growing country on the planet

However, the pressures on the second largest economy in the world do not come only from the economic environment. The almost forty years of the one-child policy continue to define the demographic evolution of the most populated country in the world and the one that is the fastest growing on the globe in the present.

Although, since 2016, Chinese couples are allowed to have two children, the birth rate has fallen to 12.43 births per thousand inhabitants, compared to the maximum reached in 2016 of 12.95 per thousand. Half of those newborns were the second child of the family.

One of the reasons for this fall is, as the specialist in demography Chen Youhua explained to the South China Morning Post last July, the drop in the number of women of childbearing age, result of the low birth rate in the nineties and that during the forty years of the one-child policy, families preferred to have a male offspring.

In 2030, one quarter of the Chinese population will have more than 65 years

Today, in China there are fewer women than men and, even though their economic possibilities are better than those of their ancestors, their incorporation into the labour market and the change in their lifestyle has motivated, as in other developed societies, a change in their willingness to become mothers.

Added to this is the drop in the number of marriages, which has plummeted by 30% since 2013. The decline is replicated throughout the country: Ningxia, one of the poorest regions, scored the largest fall, of 13%, followed by the rich Shanghai, with 12%.

With the current birth rate, the Chinese population will reach the ceiling in ten years, with 1.44 billion people, and from there it will begin to fall, according to a report by the Chinese Academy of Social Sciences. According to the United Nations, in 2024 India will overtake China as the most populous country in the world.

Consequently, China has become the fastest growing country on the planet. According to the World Bank, the percentage of people over 65 years-old will reach 26.3% in 2050, above the 22.1% that the United States will have then and very close to 30.7% in Germany. Today, the rate is at 10.6%, three points above a decade ago.

This has direct consequences on the labour force and, therefore, on the economy: according to the same study of the Chinese entity, the active population will fall in 100 million people between 2020 and 2035.

The first fashion market

For fashion, these perspectives are not good news, especially because of the dependence the sector (especially luxury) has on the Asiatic giant. China will become this year the world's leading fashion consumer market, according to several studies.

Statista anticipates that clothing sales in the country will rise to 335.47 billion dollars this year, and that the market will continue growing by 7.5% per year until 2021. Womenswear takes the majority of the revenue, with a volume of 126.31 billion dollars this year, though the largest growth comes from accessories (with peaks of around 8%), intimate and menswear.

Nevertheless, the purchasing way of Chinese consumers (also those over 65 years-old that will be the majority of the target in a few years) bears very little resemblance to Western clients.

LVMH, Richemont and Prada fell down in the stock market after Apple's announcement on China

In the largest e-commerce market, more than 40% of fashion sales are already made through the Internet, and the rate is expected to rise to 50% by 2020. Groups such as Alibaba, JD.com or Tencent take almost every aspect of commerce: from online sales platforms, to payment tools (such as WeChat or Alipay), and logistics networks.

The downturn of the Chinese economy is having an impact on especially luxury, a sector that took refuge in the Asian giant during the crisis, in what the consultancy Bain called ‘Chinese Bulimia’ and has lived for years of sales growth thanks to Chinese customers, both in Europe and in their local market. The Chinese currently represent 33% of luxury sales in the world, and in 2025 they will represent 46%, according to Bain. Half of these purchases will be made in China, compared to the current 25%.

The first setback came in 2016, when the increase in travels to Europe and the housing bubble hindered the growth of Hong Kong, which had traditionally been the ‘El Dorado’ of luxury on the continent.

Since then, the special administrative region has not yet regained the shine it had at the beginning of the decade, but it no longer weighs down the accounts of the giants, who now look with concern at the continent.

In fact, while mass market groups such as Nike, L'Oréal or Estée Lauder continue to maintain strong growing rates in the country, luxury companies such as Tiffany, LVMH or Richemont blamed the slowdown of Chinese economy to its growth lower than the expected in recent months.

The market, in addition, has shown symptoms of concern because the giants of luxury follow the steps of Apple in China. Following the announcement of the Cupertino group in January, Prada (listed on the Hong Kong stock market), Kering, LVMH, Burberry and Richemont fell back in the stock market.

info@themds.com

Validation policy for comments:

MDS does not perform prior verification for the publication of comments. However, to prevent anonymous comments from affecting the rights of third parties without the ability to reply, all comments require a valid email address, which won’t be visible or shared.

Enter your name and email address to be able to comment on this news: once you click on the link you will find within your verification email, your comment will be published.