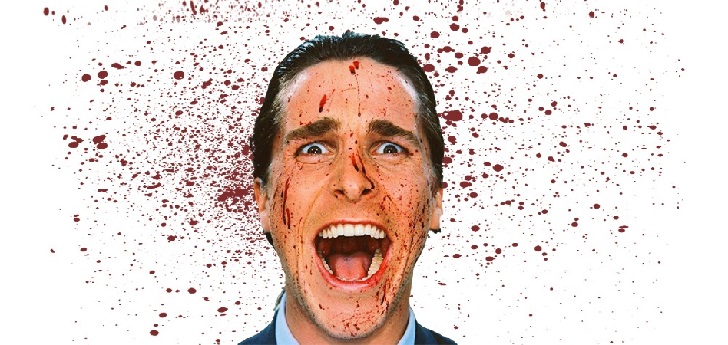

American Psycho in sneakers: the kings of suits sink their profit in five years

Hugo Boss, Ermenegildo Zegna, Giorgio Armani and Brunello Cucinelli are today 1% smaller than five years ago and all but the last have plummeted their profitability.

If American Psycho was rewritten today, Patrick Bateman would work in Silicon Valley and not on Wall Street, wear jeans and a t shirt instead of a suit, and wear sneakers. What used to be yuppies have become successful entrepreneurs, that leisure has broken into offices and that the smell of tabaco has given way to detox milkshakes, also the wardrobes have changed. The victims? The suit, tie and tuxedo.

It is the casualization of fashion, whose origins date back to the invention of sportswear in the fifties in the United States. While specialized groups like Nike or Adidas became the kings of fashion, brands such as Hugo Boss, Brunello Cucinelli, Ermenegildo Zegna or Giorgio Armani suddenly stopped being cool.

In the last five years, the revenue of these five companies has been reduced by 1%. The one that has suffered a deepest fall has been Armani, with a revenue drop of16% (excluding licenses) in the last five years.

Most of them have shrinked their sales the last five years justifying the decline in sales to a challenging environment, from the BRIC crisis to the trade war, and launching aggressive restructuring plans to boost sales.

The worst performance has been Giorgio Armani’s, which has reduced its sales by 16% in the last five years, to 2.1 billion euros, excluding license revenues. The group, which plans to return to the path of growth this year, decided in 2017 to reorganize its portfolio of brands focusing on three unique brands: Giorgio Armani (which includes Giorgio Armani Privé and Armani/Casa), Emporio Armani and AX Armani Exchange. After the merger, the company announced 110 layoffs at its Settino Torinese factory in Italy, which employed a total of 180 people.

Hugo Boss has also reorganized its brands in the recent years. The group, immersed in a restructuring process since 2016, unveiled new roadmap in 2018 that included the separation of the brand into two labels, Hugo and Boss.

Giorgio Armani is the classic fashion company that has evolved the worse in the last five years

The company justified the change as a “response to the modern lifestyle”, in which Boss addresses a client “status-oriented and wants to dress in a classic but modern way”, and Hugo wants to reach customers “with more guidance in fashion, more spontaneous and digital ”.

The company’s revenue has increased by 8.7% in the last five years but profit has plummeted by 29.4%, although it remains the largest company on the list with a revenue of 2.7 billion euros in 2018 and a net profit of 236 million euros.

Ermenegildo Zegna has also started a process of restructuring. In 2016, the company reordered its executive team with the creation of new managing roles for brand, marketing, digital and omnichannel executives, with the aim of approaching new consumers for whom Zegna is no longer necessarily a status symbol. The company reduced its sales by 4.2% in the last five years, to 1.1 billion euros, and has sunk its net result by 52%, reaching 34 million euros in the last year.

The exception to the norm is Brunello Cucinelli, which in the last five years has shot up 46.3% of its revenue and raised its net profit by 44.7%. However, the company is also the smallest of the five, with a revenue of 523 million euros in 2018. Much of its growth still comes from its expansion with new openings and external development through the multibrand channel.

info@themds.com

Validation policy for comments:

MDS does not perform prior verification for the publication of comments. However, to prevent anonymous comments from affecting the rights of third parties without the ability to reply, all comments require a valid email address, which won’t be visible or shared.

Enter your name and email address to be able to comment on this news: once you click on the link you will find within your verification email, your comment will be published.