A Changing World: US, between the trade war and the recession in Trump’s ‘second act’

The first world power faces a complex year that could end with the country falling into recession, while the Government deals with the longest closing of its history.

Fashion business’ game board has turned around. The legacy of the crisis, instability, the peak of populist movements, the attempts to move backwards in globalization and the threat of the global economic downturn has made almost all the predictions fail one by one. The world undergoes a transformation, and fashion, as a global player, must adapt and transform with it. Modaes.es will go through the keys for the new order in the most important markets in the sector and how this can affect one of the most globalized business in the world.

When we talk about domestic economy, the Twitter timeline of Donald Trump is a feast of optimism. He certainly has his reasons: the United States lives one of its longest expansive periods in history; the confidence of consumers is at its maximum level; the unemployment, in minimums, and the anabolic effects of its fiscal reform keep giving joys to the market. However, 2019 started with a lot of fronts open: on the one hand, the trade war with China, in which the United States has less to lose than its rival; on the other hand, the threat of a downturn at the end of 2019 and the possible change of rhetoric of the Federal Reserve Bank, whose already announced increase of rates much quarantine.

The trade war was one of the reasons the International Monetary Fund (IMF) used to reduce its expectations of global economy growth last October. For the US economy, the organism led by Christine Lagarde anticipates a growth of 2.5% for 2019, in comparison with 2018’s 2.9%.

If the first world power maintains upward rates until July, what will foreseeably happen, the country will reach its most expansive period, with ten years of uninterrupted growth. Among the driving forces is the strength of the employment market, the continued increase of the wages and the last breath of Trump’s fiscal reform. Nevertheless, analysts agree in the fact that recession could arrive in 2019 or 2020.

The economy of the United States continues going upwards until July, the country will reach the most expansive period of its history

On average, the analysts interviewed by The Wall Street Journal contemplate a possibility of 25% that the United States falls into a downturn in 2020, the highest level since October 2011. A survey by Bloomberg also values in 25% the possibility such a recession occurs in the following twelve months.

In the short term, firms like JP Morgan have already started cutting up its estimates for the first quarter due to the shutdown of the Federal Government, a measure that, according to Trump, could “last for months or even years”. Last Saturday, the shutdown made 21 days, the longest in the history of the country. The analysts estimate that this closure (that left 800 thousand officials without a wage) could have an impact in growing between 0.1 and 0.2 percentage points.

The other great short term risk is the trade war. Washington and Beijing concluded last 9 January the first conversations to reach an agreement, which prolonged a day more than the expected and increased the optimism of markets over the possibility of signing a deal. The two great powers of the world agreed in December to take a ninety-days truce in order to open up conversations, under the pressure by the impact this battle is already having on global economy.

Analysts estimate the Government shutdown could have an impact between 0.1 and 0.2 points in economic growth

The agreement also implies to negotiate on the areas the United States demands reforms to China: the forced transfer of technology, intellectual property protection, non-tariff barriers, piracy and computer incursions, services and agriculture.

The United States did reached an agreement with its North American partners, Canada and Mexico, with the signing of a new free trade agreement in 2018, renamed Usmca in English.

However, Washington still holds tensions with Mexico, after Trump resumed the controversial measure of building a wall in the border between both countries. In fact, it was Trump’s request of 5.7 billion dollars to the Congress to build the wall what caused the shutdown of the Government.

In the positive side of the balance, employment in the United States is still robust. The country already accumulates 99 months in a row of employment growth, a string that could be interrupted by the Federal Government shutdown.

Employment and consumers’ confidence continues being robust, but the experts agree that the country will face a recession in 2019 or 2020

According to the forecasts by IMF (produced before the shutdown), the unemployment will fall until 3.5% in 2019, in contrast with 2018’s 3.9%. Moreover, salaries continue increasing, and for the first time, there is more job offer than seekers.

The consumption also keeps giving joys. According to the last available data, consumption (that corners 70% of the GDP), grew more than the expected in November, with a rise of 0.4% in comparison with last month. The saving rate, on its behalf, is placed in minimums of five years, in only 6%. Moreover, the increase in consumption is not making much impact to inflation, which remained in 1.8%, below the 2% that was set as Fed objective.

The annalists underline the “dichotomy” between the sentiment of markets and consumers, and anticipate a downturn also in private consumption facing 2019. The downturn will come first from the companies, which are already moderating its disbursement as they gradually disappear the effects of the fiscal reform.

The Federal Reserve started to step back in its rhetoric and could put off the interest rate increase until 2020

Another one of the keys to face 2019 is the position the Federal Reserve will adopt. The analysts are already starting to deduct that the new interest rate increase announced for this year could not be achieved, after Jerome Powell, president of the US central bank, began to change its rhetoric on December.

Last week, Powell affirmed that the FED “is in a place where it can be patient and flexible”. The interest rates are now in 2.5%, at 2008 levels, which leaves the FED a scarce margin to move in case a downturn occurs. Everything points out the European counterpart, the BCE, will change its strategy and delay the increase of interest rates until 2020.

The race towards the White House begins

In the middle of the threat of a downturn, the political background is not much more stable. Added to the Government shutdown is the threat of an impeachment, after the democrats took control of the Congress last November.

Moreover, the race towards the next presidential elections began, scheduled for 2020. Trump has not confirmed yet if he will be participating for the re-election, while the Democrats start to show their cards.

The history traditionally favoured the person in power: since George Washington sworn in as the first president of the country, only four presidents that went to re-election lost the polls.

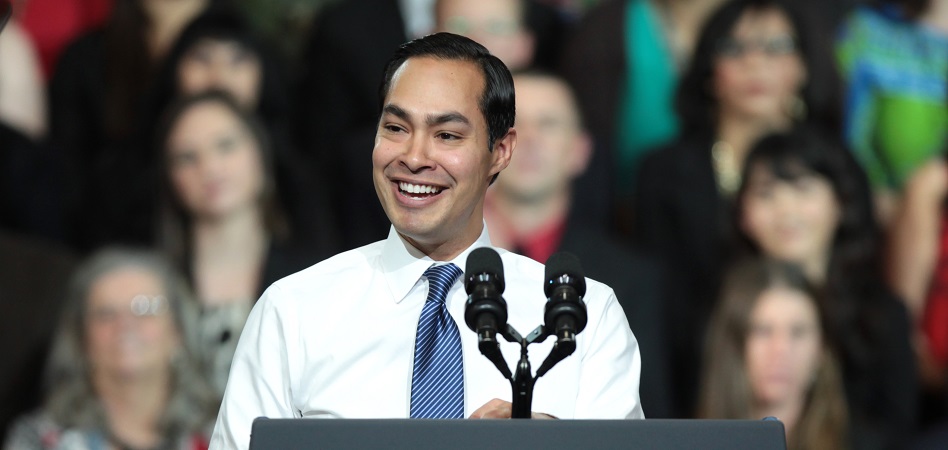

On the Democrat side, Julián Castro, former mayor of San Antonio (Texas) and former housing secretary under Obama’s mandate, announced his candidature last Saturday. The democrat congresswoman Tulsi Gabbard also runs for the presidency. She forecasts to perform the formal announcement during the week.

The year of ‘millennials’

According to Pew Research Center, in 2019 there will be, for the first time, more millennials than baby boomers in the United States. That generation, marked by the crisis and 11/9, thinks, acts and consumes in a different manner than the previous one. Among the numerous studies written about them, the aspects that coincide the most are their willing to use over ownership, what motivated a boom of collaborative economy, their digitalization (they are not digital native, but they are the first generation that feels completely comfortable online) and their greater sensitivity towards gender equality and sustainability.

Moreover, they are more diverse: only 56% of the US millennials are white, in comparison with three-quarters of the baby boomers. This new mass of consumers, born between 1981 and 1996, do not have yet the purchasing power of their predecessors, but adapting to new tastes and habits is key for the companies of any sector, and the ones that have not started to do so are already being left behind.

In fashion, there are many examples, especially in niche sectors like jewelry, cosmetics, and lingerie. Giants like Victoria’s Secret, thought by and for baby boomers, are seeing how younger companies designed for this new public take a step forward with a totally different product, communication, and a distribution strategy.

In jewelry, Tiffany announced in 2016 its new strategic plan to reach millennials and in cosmetics, Coty is not fully capitalizing the mega-operation with Procter&Gamble while new firms like Fenty, with Rihanna at the front, take sales (and Instagram) by storm.

What about fashion?

The United States continues to be the first market in the world for fashion and retail, and is home of titans like Macy’s, Amazon, Nike or Gap. However, it is also the first market to suffer the effects of distribution transformation, which crystallized in the Retail Apocalypse and that entailed the closure of thousands of stores around the country and the crisis of giants like Sears.

Statista anticipates that China will surpass the United States this year as the first global clothing market, with 335.4 billion dollars in 2019, in contrast with 334.1 million dollars that will generate fashion sales in the first economic power.

Like in other developed markets, it is forecasted that fashion business will slowdown in the following years, with a growing rate of 2.6% in 2019, 2.3% in 2020 and 2.1% in 2021, according to Statista. The driver of this expansion will be again, sportswear, which will register rates of around 4% per year in the upcoming triennium.

By channels, the online will continue to gain ground at a rapid pace in retail commerce, going from 18% of the sales in 2017 to 21% this year and almost a quarter of the total business in 2020.

info@themds.com

Validation policy for comments:

MDS does not perform prior verification for the publication of comments. However, to prevent anonymous comments from affecting the rights of third parties without the ability to reply, all comments require a valid email address, which won’t be visible or shared.

Enter your name and email address to be able to comment on this news: once you click on the link you will find within your verification email, your comment will be published.